Bankruptcy should not be taken lightly and it should be used as a last resort. Because bankruptcy can have lasting effects on your credit score, it’s important to consult with our experienced attorneys at Marty Martin Bankruptcy Law before filing for bankruptcy in Oklahoma. Call us today to request your free consultation, where we’ll walk you through your potential options for debt relief at no risk or charge to you. In the meantime, we hope this guide on how to file for bankruptcy in Oklahoma will walk you through each step of the process, making it easier to file for yourself or letting you know when it’s time to seek legal counsel.

Bankruptcy should not be taken lightly and it should be used as a last resort. Because bankruptcy can have lasting effects on your credit score, it’s important to consult with our experienced attorneys at Marty Martin Bankruptcy Law before filing for bankruptcy in Oklahoma. Call us today to request your free consultation, where we’ll walk you through your potential options for debt relief at no risk or charge to you. In the meantime, we hope this guide on how to file for bankruptcy in Oklahoma will walk you through each step of the process, making it easier to file for yourself or letting you know when it’s time to seek legal counsel.

Table Of Contents

- Initial Meeting With An Attorney

- How A Lawyer Helps

- Post-Discharge Tips

- Our Guide To Bankruptcy In Oklahoma

- Infographic

- Bankruptcy Statistics

- FAQs

Different Types Of Bankruptcy

Chapter 7 isn’t the only type of bankruptcy that someone can file for. There are actually a few other bankruptcy types that either an individual or a company can file for too. These bankruptcy types vary in usage as some are for municipalities, companies, certain organizations, businesses, and other entities. Bankruptcy overall is a great way for either individuals or companies to settle their debts and get out of the financial troubles that they find themselves in. It’s important to understand the different types of bankruptcy and which ones are for individuals and which ones are for entities like companies or municipalities. Keep reading to learn more about bankruptcy and how to file bankruptcy in Oklahoma from an experienced law firm.

Chapter 7 Bankruptcy

Chapter 7 bankruptcy is a liquidation proceeding in which the debtor’s nonexempt assets are sold by the trustee and the proceeds are distributed to creditors. The debtor is then discharged from most debts.

Chapter 13 Bankruptcy

Chapter 13 is similar to chapter 7 in one important way. That way is that this bankruptcy type, like chapter 7, is typically filed by individuals. They differ though in that chapter 7 has someone liquidate assets to pay back creditors and chapter 13 puts someone on a repayment plan to pay back their debts. Chapter 13 is a good way for individuals to keep their assets, like a house or car, and still be able to repay their debts with a monthly plan. This bankruptcy type could be a great option for someone who wishes not to have assets liquidated and would rather be put on a repayment plan. Contact Marty Martin Bankruptcy Law today for assistance on how to file bankruptcy in Oklahoma and to learn more about the bankruptcy process itself.

Other Types of Bankruptcy

There are other types of bankruptcy that a business may file for. Chapter 11 bankruptcy is a way for businesses or big corporations and organizations to remain in business while they repay their debts. They will be placed on a repayment plan to repay their creditors while still being allowed to operate the business or company. Many large companies have gone through this process. Another bankruptcy type that is filed by an entity like a municipality or school district is chapter 9. This bankruptcy type serves as a way for municipalities or school districts to repay their debts while still operating the district or municipality. A repayment plan will be established by creditors to ensure that a realistic financial decision for repayment is established.

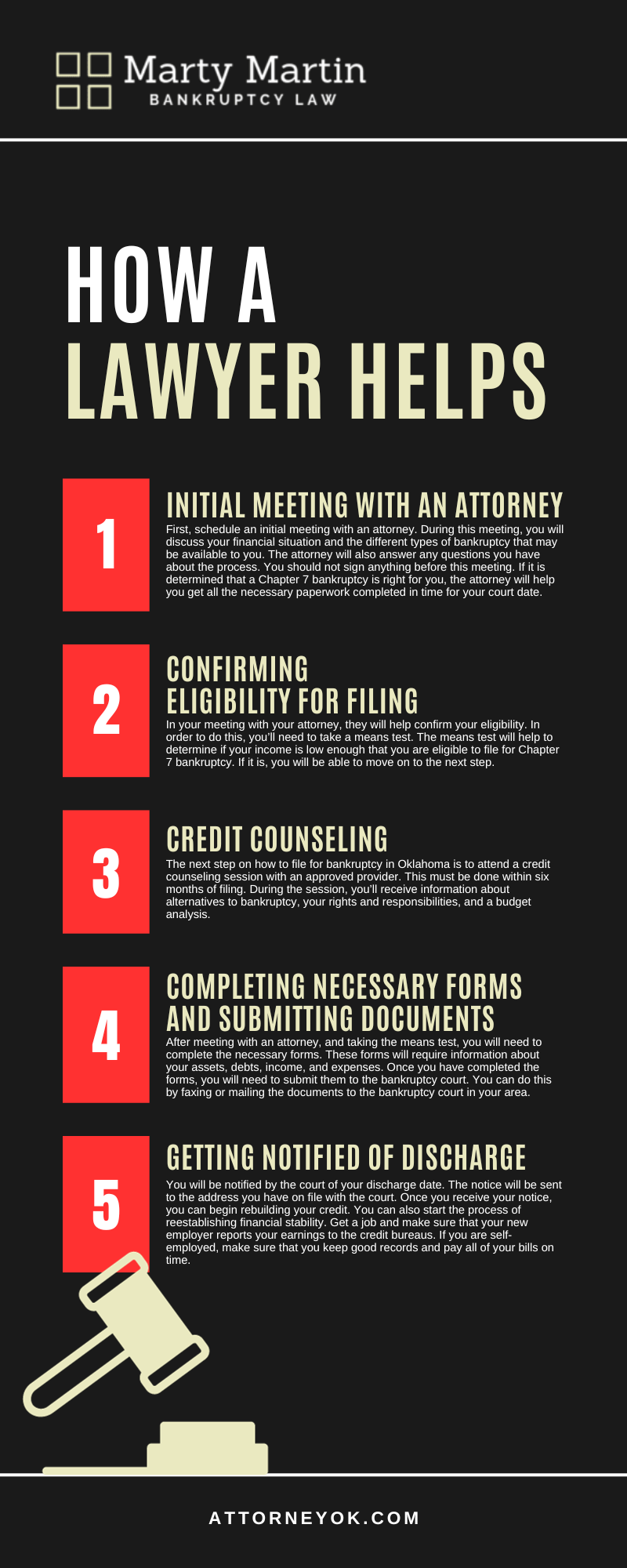

Initial Meeting With An Attorney

First, schedule an initial meeting with an attorney. During this meeting, you will discuss your financial situation and the different types of bankruptcy that may be available to you. The attorney will also answer any questions you have about the process. You should not sign anything before this meeting. If it is determined that a Chapter 7 bankruptcy is right for you, the attorney will help you get all the necessary paperwork completed in time for your court date.

Confirming Eligibility For Filing

In your meeting with your attorney, they will help confirm your eligibility. In order to do this, you’ll need to take a means test. The means test will help to determine if your income is low enough that you are eligible to file for Chapter 7 bankruptcy. If it is, you will be able to move on to the next step.

Credit Counseling

The next step on how to file for bankruptcy in Oklahoma is to attend a credit counseling session with an approved provider. This must be done within six months of filing. During the session, you’ll receive information about alternatives to bankruptcy, your rights and responsibilities, and a budget analysis.

Completing Necessary Forms And Submitting Documents

After meeting with an attorney, and taking the means test, you will need to complete the necessary forms. These forms will require information about your assets, debts, income, and expenses. Once you have completed the forms, you will need to submit them to the bankruptcy court. You can do this by faxing or mailing the documents to the bankruptcy court in your area. You may also be able to file these documents electronically.

Getting Notified Of Discharge

You will be notified by the court of your discharge date. The notice will be sent to the address you have on file with the court. Once you receive your notice, you can begin rebuilding your credit. You can also start the process of reestablishing financial stability. Get a job and make sure that your new employer reports your earnings to the credit bureaus. If you are self-employed, make sure that you keep good records and pay all of your bills on time. Pay off any outstanding debts as soon as possible so that they don’t become collector accounts which negatively affect your credit score for years after being settled.

How A Lawyer Helps Infographic

Post-Discharge Tips

Congratulations on completing the bankruptcy process! Here are a few tips to help you get back on your feet after the discharge:

- Keep up with payments.

- Stay in contact with creditors.

- File taxes as required.

- Don’t try to borrow money from friends or family.

Contact an attorney at Marty Martin Bankruptcy Law today for help on how to file for bankruptcy in Oklahoma today.

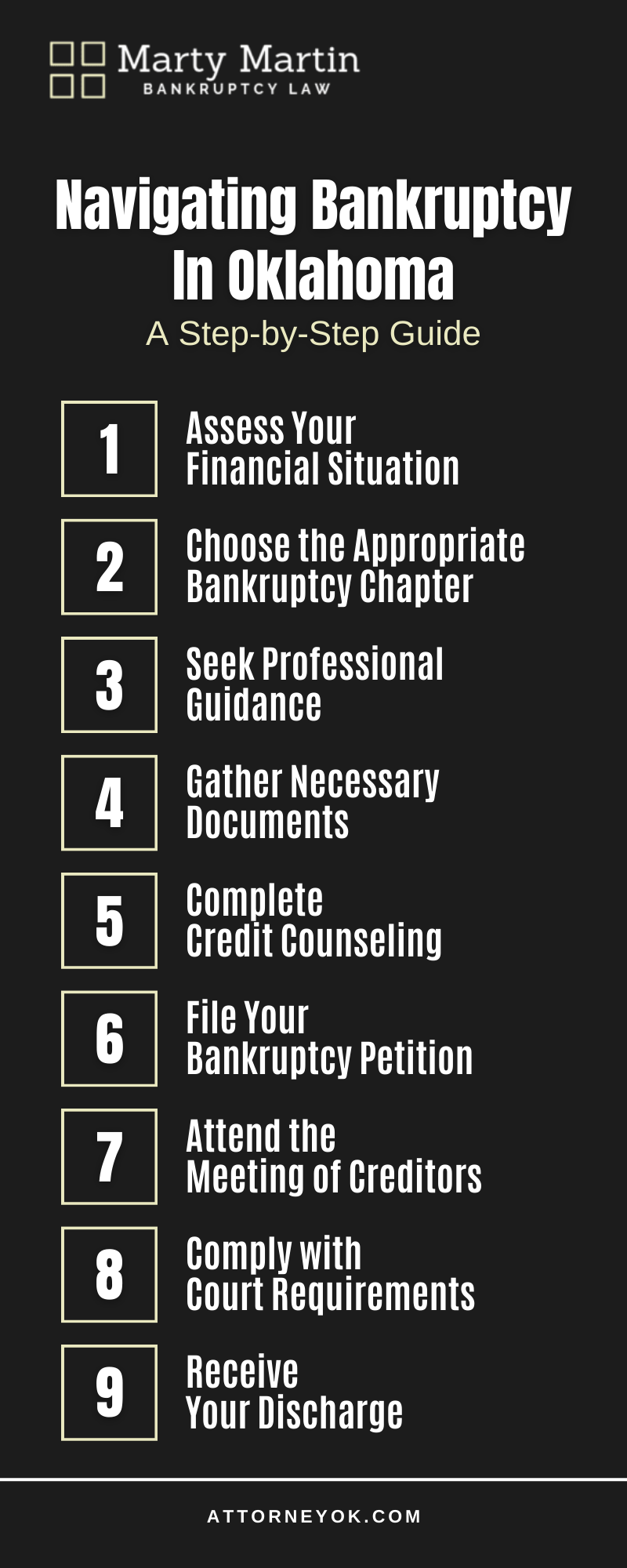

Our Guide To Bankruptcy In Oklahoma

Filing for bankruptcy can be a daunting process, but with the right guidance and support, it can be a fresh start for those facing financial difficulties. At Marty Martin Bankruptcy Law, we understand the challenges you may be facing, and we’re here to help. In this step-by-step guide, we’ll walk you through how to file bankruptcy in Oklahoma, providing you with the information you need to make informed decisions about your financial future.

- Assess Your Financial Situation

Before diving into the bankruptcy process, take a close look at your financial situation. Determine if bankruptcy is the right option for you by evaluating your debts, income, and assets. Understanding your financial standing will help you decide which type of bankruptcy to pursue.

- Choose the Appropriate Bankruptcy Chapter

Oklahoma offers two common types of bankruptcy: Chapter 7 and Chapter 13. Chapter 7 is often referred to as “liquidation” bankruptcy, while Chapter 13 is a “reorganization” bankruptcy. Each has its eligibility criteria and benefits, so it’s crucial to choose the one that aligns with your financial goals and circumstances.

- Seek Professional Guidance

Filing for bankruptcy involves complex legal procedures and paperwork. It’s highly advisable to consult with an experienced bankruptcy attorney. Our team can help you understand the intricacies of bankruptcy laws in Oklahoma and guide you through the entire process.

- Gather Necessary Documents

To file for bankruptcy, you’ll need to provide detailed financial information. This includes income records, tax returns, a list of assets and debts, recent financial transactions, and more. Your attorney will help you compile and organize these documents accurately.

- Complete Credit Counseling

Before filing for bankruptcy in Oklahoma, you’re required to undergo credit counseling from an approved agency. This counseling aims to help you explore alternatives to bankruptcy and gain a better understanding of your financial situation.

- File Your Bankruptcy Petition

With the assistance of your attorney, you’ll prepare and file your bankruptcy petition and related documents with the Oklahoma bankruptcy court. The court will assign a trustee to oversee your case and schedule a meeting of creditors.

- Attend the Meeting of Creditors

During this meeting, you’ll answer questions from the trustee and any creditors who wish to attend. Your attorney will be by your side to provide support and guidance throughout the process.

- Comply with Court Requirements

Depending on the type of bankruptcy you file, you’ll need to meet specific court requirements, such as completing a financial management course. Your attorney will ensure you fulfill all necessary obligations.

- Receive Your Discharge

Upon successful completion of your bankruptcy case, you will receive a discharge, which eliminates eligible debts. This fresh start allows you to rebuild your financial life with a clean slate.

Navigating Bankruptcy In Oklahoma Infographic

When You Need Help Filing

Filing for bankruptcy in Oklahoma can be a life-changing decision, and it’s essential to navigate the process correctly. At Marty Martin Bankruptcy Law, we’re here to guide you every step of the way, from assessing your financial situation to receiving your discharge. If you’re wondering how to file bankruptcy in Oklahoma, trust our experienced team to provide the support and legal expertise you need.

Don’t let financial hardship hold you back. Contact us today to schedule a consultation and take the first step toward a brighter financial future. We’re here to help you regain control of your finances and start anew.

Bankruptcy Statistics

According to statistics released by the Administrative Office of the U.S. Courts, annual bankruptcy filing increased by 13 percent. The number of filings totaled 433,658 in the year ending September 2023, compared with 383,810 cases in the previous year.

Business filings rose 29.9 percent, from 13,125 to 17,051, in the year ending Sept. 30, 2023. Non-business bankruptcy filings rose 12.4 percent to 416,607, compared with 370,685 in September 2022.

FAQs

What Are The Different Types Of Bankruptcy Available In Oklahoma?

Many individuals who want to learn how to file bankruptcy in Oklahoma usually file for certain types of bankruptcy like Chapter 7 or Chapter 13. Chapter 7, also known as “liquidation bankruptcy,” allows you to discharge most unsecured debts, while Chapter 13 enables you to create a manageable repayment plan for your debts over three to five years. The choice between these options depends on your unique financial situation and goals. It’s important to note that bankruptcy laws and eligibility criteria can be complex, so seeking the guidance of an experienced attorney is crucial to determine the best path forward for your specific circumstances.

What Are The Eligibility Requirements For Filing Bankruptcy In Oklahoma?

There are certain criteria that must be met for anyone who is wondering how to file bankruptcy in Oklahoma, and it is important that all requirements must be met. For Chapter 7, you’ll need to pass the means test, which evaluates your income and expenses. Chapter 13 requires you to have a steady income to create a repayment plan. Our experienced bankruptcy attorneys can assess your eligibility and help you choose the most suitable option. We understand that each individual’s financial situation is unique, and we’ll work with you to ensure you meet the necessary requirements while protecting your interests.

How Does Bankruptcy Affect My Assets, Such As My Home And Car?

Depending on the type of bankruptcy that you file and what kind of debt that you have, there are many ways that bankruptcy can impact your assets. Under Chapter 7, non-exempt assets may be sold to repay creditors, but exemptions protect your essential property, such as your primary residence and vehicle. Chapter 13 allows you to keep your assets while repaying a portion of your debts over time, making it a suitable option for those looking to protect their property. Our dedicated legal team will carefully assess your assets and develop a strategy to minimize any potential impact on your valuable possessions.

Will Bankruptcy Affect My Credit Score, And How Long Does It Stay On My Credit Report?

While filing for bankruptcy is a major decision that should not be taken lightly or rushed and does affect your credit score, it will only be temporarily negatively impacted, and it will be able to recover eventually if you take the right actions. Chapter 7 bankruptcies typically stay on your report for ten years, while Chapter 13 bankruptcies stay for seven years. However, with responsible financial management, you can start rebuilding your credit soon after your bankruptcy is discharged. Our experienced bankruptcy attorneys can provide guidance on how to gradually improve your credit score, offering you a path toward financial recovery and stability.

What Steps Should I Take To Begin The Bankruptcy Process In Oklahoma?

To initiate the bankruptcy process in Oklahoma, you’ll need to gather financial documents, complete credit counseling, and file a petition with the bankruptcy court. Working with an experienced bankruptcy attorney is crucial, as they can guide you through each step, ensure all necessary paperwork is filed correctly, and represent your interests during court proceedings. If you need help with tasks like preparing your financial documents, understanding eligibility requirements, and want to learn more details about how to file bankruptcy in Oklahoma properly, schedule a consultation with a lawyer right away.

Marty Martin Bankruptcy Law, Bankruptcy Lawyers