Bankruptcy Lawyer Stillwater, OK

Deciding whether to file for bankruptcy can be very difficult. There are a number of reasons that a person may be forced to file for bankruptcy. You will need to weigh a lot of financial and personal considerations as you process what to do, which can be very stressful. While it may not seem the best solution to relieve your debt it may be the only path forward. Finding an experienced bankruptcy lawyer in Stillwater, OK can help you understand your options. Law Offices of Marty D. Martin is here to help you. Call us today for a free consultation to see whether you should pursue bankruptcy.

Deciding whether to file for bankruptcy can be very difficult. There are a number of reasons that a person may be forced to file for bankruptcy. You will need to weigh a lot of financial and personal considerations as you process what to do, which can be very stressful. While it may not seem the best solution to relieve your debt it may be the only path forward. Finding an experienced bankruptcy lawyer in Stillwater, OK can help you understand your options. Law Offices of Marty D. Martin is here to help you. Call us today for a free consultation to see whether you should pursue bankruptcy.

STILLWATER BANKRUPTCY LAWYER

- CONSIDERATIONS BEFORE FILING FOR BANKRUPTCY

- WHAT TO EXPECT WHEN FILING BANKRUPTCY

- WHAT HAPPENS RIGHT AFTER FILING FOR BANKRUPTCY

- YOUR CREDIT SCORE AFTER FILING BANKRUPTCY

- 5 STEPS TO HELP PREPARE FOR BANKRUPTCY

- STILLWATER BANKRUPTCY LAW INFOGRAPHIC

- WHY YOU SHOULD HIRE A BANKRUPTCY LAWYER

- HOW A BANKRUPTCY LAWYER CAN HELP YOU

- WITH EXPERIENCED LEGAL HELP, YOU CAN FILE FOR BANKRUPTCY

Considerations Before Filing for Bankruptcy

Filing for bankruptcy is a major decision. Before you file, you should understand the two different types of bankruptcy, and which one would be most beneficial to you. The two types of bankruptcy are:

Chapter 7 | Chapter 7 is the most common form of bankruptcy that people file. It eliminates many kinds of debt from costly bills, loss of income, and medical expenses by liquidating your assets to pay off your debts. Assets like your house, car, and furniture may be sold to pay your debts, which can be a downside for some people. Chapter 7 bankruptcy has the added benefit of stopping debt collectors from issuing collections notices, which can add pressure to an already stressful situation. It should be noted that some of the debt categories can not be satisfied by Chapter 7 bankruptcy including child support, student loans, homeowners association fees, and some forms of tax debt.

Chapter 13 | This type of bankruptcy allows you to keep your property while making a plan to pay off your debt over a certain amount of time. Chapter 13 is a good option for people who have a stable form of income. It will allow you to pay off a portion of your debts over an agreed upon time period and then have the rest discharged if you successfully complete the plan. Another advantage of Chapter 13 bankruptcy is that it will pause foreclosures, evictions, and repossessions. Under Chapter 13 bankruptcy, you may be able to discharge different debts like property damage you caused, homeowner’s association dues, and government fines or penalties.

What To Expect When Filing Bankruptcy

Filing for bankruptcy is often a stressful time full of uncertainty. This is especially true if it is something that you don’t have previous experience doing. Knowing what to expect when you contact Marty Martin Bankruptcy Law, a bankruptcy lawyer in Stillwater OK, can help to ease the stress of the situation.

What Happens Right After Filing for Bankruptcy

As soon as your attorney helps you file your bankruptcy, you will receive a case number and begin working with a bankruptcy trustee. The trustee oversees everything that goes on during your bankruptcy case. He or she may require you to fill out additional forms or provide additional documents, which your attorney can help you to prepare.

Your bankruptcy trustee will also conduct the meeting of the creditors. During this meeting, you will be asked about your assets and debts while under oath. Technically, your credits can attend this meeting to ask questions as well, but most of the time, only you and your trustee are present.

This is also when your automatic stay will begin, which is what protects you from having your assets seized by creditors. They cannot call you or otherwise try to collect payment from you for most types of debts. However, it is important to note that student loans, child support, and alimony are typically exempt from the stay.

Your Credit Score After Filing Bankruptcy

After your bankruptcy lawyer in Stillwater OK helps you to file for bankruptcy, Chapter 7 and Chapter 13 bankruptcies will show up on your credit report. Filing for Chapter 7 will stay on your credit for 10 years. If you file for Chapter 13, it will stay on your record for 7 years if you complete it and 10 years if you do not. Initially, filing for bankruptcy will lower your credit score by up to 200 points. However, as soon as your bankruptcy discharge is entered, you can begin rebuilding your credit. Many times, your credit will see a major improvement within two years of the filing.

Typically, after you file for bankruptcy, you will begin to receive credit card offers in the mail. Secured credit offers are cards that require you to pay an initial deposit. Unsecured cards are cards that do not require you to pay a deposit. While it is a good idea to accept one or two of these offers to build credit, a good bankruptcy lawyer in Stillwater OK will recommend you do not overdo it. Marty Martin Bankruptcy Law recommends no more than two of these cards and that you pay off the balance in full every month.

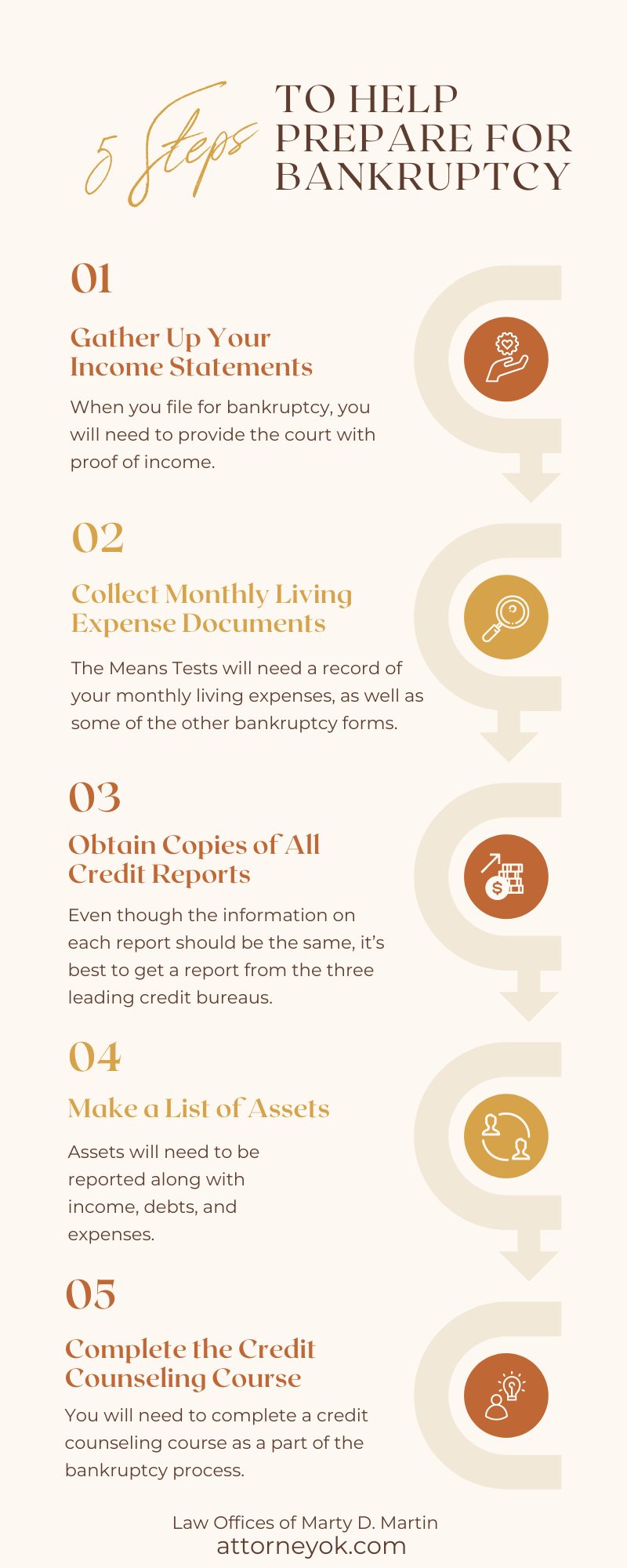

5 Steps To Help Prepare for Bankruptcy

If you’ve been struggling with debt and decided to pursue bankruptcy, it’s best to go into the process with a clear understanding of what to expect. It can be overwhelming and being prepared can help. While you will get some direction from your bankruptcy lawyer in Stillwater, OK, you should still be in control of things when you head to the Marty Martin Bankruptcy Law office to get started. Here are a few steps for preparing for bankruptcy.

1. Gather Up Your Income Statements

When you file for bankruptcy, you will need to provide the court with proof of income. Depending on which type of bankruptcy you will be filing, you will have to complete a Means Test. This is a comparison of your income with the averages for the households in your state. Your income will need to fall below a certain threshold to be eligible for Chapter 7 unless a second element of the Means Test allows you to qualify. You will need a minimum of six months’ proof of income and tax returns as proof of income.

2. Collect Monthly Living Expense Documents

The Means Tests will need a record of your monthly living expenses, as well as some of the other bankruptcy forms. Having copies of your rent or mortgage statement, utility bills and other paperwork already in a file can help expedite the way you complete the test or fill out the forms. Your bankruptcy lawyer in Stillwater, OK may also need copies.

3. Obtain Copies of All Credit Reports

Even though the information on each report should be the same, it’s best to get a report from the three leading credit bureaus. You will use the reports to make a list of all the creditors you have, as each creditor you owe money to must be included on your bankruptcy forms. You will need to list unsecured, secured and priority unsecured creditors when you are preparing your paperwork.

4. Make a List of Assets

Assets will need to be reported along with income, debts, and expenses. Develop a list that includes all the property you own, vehicles, items of worth and more. Financial statements for retirement, life insurance, or more should also be gathered.

5. Complete the Credit Counseling Course

You will need to complete a credit counseling course as a part of the bankruptcy process. You won’t be able to file a Chapter 7 case without it.

When you are facing bankruptcy, consider calling the Marty Martin Bankruptcy Law office. Be prepared by knowing what to expect

Stillwater Bankruptcy Law Infographic

Why You Should Hire a Bankruptcy Lawyer

Review Your Alternatives

A reputable bankruptcy lawyer in Stillwater, OK, such as Marty Martin Bankruptcy Law, will help you go over all your legal and financial options. Bankruptcy should be your final option, and it should only be pursued when every other measure has failed. In addition, it may not be your best option. A great attorney will guide you in the options that work best for your case.

Then, this professional will guide you in what type of bankruptcy you may qualify for. For example, although you may be able to eliminate all your debt through a Chapter 7 bankruptcy, you may also lose your home if you are in foreclosure. However, a Chapter 13 bankruptcy allows you to reorganize your debt and create a three-to-five-year payment plan. It also protects your home.

Prepare Your Filings

During these procedures, a bankruptcy lawyer in Stillwater, OK will calculate the type of bankruptcy you qualify for and the payments you can afford to make on your debt. They also discuss any special circumstances while they determine the value of your assets.

They will help you fill out all your paperwork, including your asset valuations, expenses and recent financial transactions. They will help you determine which of your bills are necessary.

The goal of bankruptcy is to eliminate any debt you can while creating payment plans that you can afford for your remaining debts. Unfortunately, not all your debt is eliminated during bankruptcy. You have to meet special conditions before a discharge occurs. However, your attorney can apply for several exemptions so that you retain your property.

Protect You From Creditors

The minute your bankruptcy is filed, your creditors are no longer allowed to contact you or pursue collections of any kind. If your home is in foreclosure or your other assets are being repossessed, these processes stop immediately.

Then, during the process, your bankruptcy lawyer in Stillwater, OK will deal with any creditors who violate the judge’s order that prevents collection. Your creditor may even be held in contempt of court. A reputable firm, such as Marty Martin Bankruptcy Law, will also negotiate with your creditors to get you the best deal, whether that is a settlement or a reasonable payment plan. They may get your interest rates reduced while ensuring that you keep your home and car.

Guide You

Your bankruptcy lawyer in Stillwater, OK is your guide throughout the process. These professionals will keep you updated on what is going on with your case. They will also guide you about what paperwork, such as tax returns and other financial documents, needs to be submitted and help you create and practice your testimony.

How a Bankruptcy Lawyer Can Help You

Finding a reputable bankruptcy lawyer in Stillwater, OK like Law Offices of Marty D. Martin will be critical to the success of your case. An experienced bankruptcy lawyer will understand if you need to file for bankruptcy, and, if so, what form of bankruptcy is the best fit for you based on your unique financial situation. They will be able to provide you with counsel on difficult questions like whether you should file with your spouse and how filing will affect any affiliated business partners. Hiring a lawyer will allow you to avoid costly mistakes when completing paperwork and they will be able to help you navigate a complicated court process. Even after you have successfully filed for bankruptcy, a lawyer can help you if other issues arise like creditors persisting in trying to collect from you.

Whether you’re drowning in debt or simply don’t have enough money to pay your bills, bankruptcy can help you get back on your feet. Bankruptcy is a legal option available to people who are unable to pay their debts, and it’s often the most effective way of getting out from under that weight. The process will allow you to either eliminate or repay some of your outstanding debts through a repayment plan. If you want to receive a discharge of all eligible debts, then you must meet certain requirements, which a bankruptcy lawyer in Stillwater, OK from Marty Martin Bankruptcy Law, can help with.

A Bankruptcy Can Stop Foreclosure and Repossession

If you’re trying to decide between either paying your mortgage or your student loan payment and find yourself struggling with both, bankruptcy can help. In many cases, even after a foreclosure or repossession, you can keep your home or car if the arrears (the amount you owe) on the loan can be caught up with a Chapter 13 plan.

The first step is filling out the petition for bankruptcy, which is called the “voluntary petition,” since it’s not required by any party but instead is filed by a debtor who can’t pay his or her creditors. You’ll need to fill out this petition as well as other forms that discuss your assets, income and expenses. This can be difficult because debtors often have trouble keeping track of everything they own, but if you have access to records like tax returns and bank statements, it will make the process much easier and more accurate.

Once the petition has been filed and approved by the court, an automatic stay will go into effect against any actions taken by creditors.

With Experienced Legal Help, You Can File for Bankruptcy

Many people believe that filing for bankruptcy means that they have failed or that they have made poor financial decisions. This is simply not true! Filing for bankruptcy is a way to start fresh – finally getting rid of old debt and moving forward with a clean slate. If you would like to learn more about your options, contact a bankruptcy lawyer in Stillwater, OK from Marty Martin Bankruptcy Law today.

Filing bankruptcy is a decision that shouldn’t be taken lightly. If you make the decision to file for bankruptcy, there are a few things that you need to know about the process. First, you’ll want to find an experienced attorney to represent you. Second, your lawyer can help you determine which type of bankruptcy is best for your situation. Third, your bankruptcy lawyer will help you gather all of the necessary paperwork and make sure it’s filed correctly. Fourth, after filing, it’s important that you work with your attorney throughout the process because there are several steps involved before your debts are wiped out and you begin rebuilding your credit. Finally, once the process comes to an end, your bankruptcy lawyer Stillwater OK from Marty Martin Bankruptcy Law can help you understand what needs to be done in order to rebuild your credit and prevent financial problems in the future.

Don’t wait any longer. Find a well-respected bankruptcy lawyer in Stillwater, OK to help get your life back on track. Call us at Law Offices of Marty D. Martin today to schedule your free consultation.