Oklahoma City Chapter 13 Bankruptcy

Oklahoma City Chapter 13 Bankruptcy

Many people in Oklahoma who are considering bankruptcy have questions about the specifics of the bankruptcy process and its potential effects on their financial problems before ever filing a bankruptcy petition. These are the issues individuals face immediately and often discuss with their bankruptcy attorney when meeting for the first few times.

Further down the road, petitioners generally have more questions as to what to expect after the process is completed and their debt is discharged. Their focus has shifted to life after bankruptcy, and many are surprised at how promising that life will seem. A Chapter 13 bankruptcy lawyer Oklahoma City, OK clients trust from the Law Offices of Marty D. Martin can answer all your questions.

How Chapter 13 Bankruptcy Works In Oklahoma

Chapter 13 bankruptcy, often referred to as a “wage earner’s plan,” allows people who are earning a regular income to develop a plan to repay all or part of their debts over time. In Oklahoma, this form of bankruptcy provides debtors with an opportunity to save their homes from foreclosure, reschedule secured debts, and consolidate their debt into manageable payments.

An Oklahoma City, OK, Chapter 13 bankruptcy lawyer from Marty Martin Bankruptcy Law can help you understand your eligibility for Chapter 13 bankruptcy and work with you to develop a payment plan and file for bankruptcy. Here’s what you can expect:

Eligibility For Chapter 13

To qualify for Chapter 13 bankruptcy in Oklahoma, the petitioner must have a stable source of income that can support regular payments to a trustee and meet a certain debt threshold.

Filing The Petition

The process begins by filing a petition with the Oklahoma bankruptcy court, including detailed information about your assets, liabilities, income, and expenditures, plus a proposed repayment plan. An Oklahoma City Chapter 13 bankruptcy lawyer can help you properly fill out and file this.

The Repayment Plan

The repayment plan is central to Chapter 13 bankruptcy. In Oklahoma, this plan must be submitted within 14 days of filing your petition. The plan proposes how you will pay back creditors, prioritizing secured debts like mortgages and car loans, followed by unsecured debts such as credit card balances and medical bills.

Typically, the repayment plan spans three years if your income is below the state median and five years if it is above. During this period, you make regular payments to a bankruptcy trustee who distributes these funds to your creditors according to the terms of your plan.

Automatic Stay Protection

Upon filing for Chapter 13, an automatic stay goes into effect. This legal provision halts most collection actions against you, including foreclosure, garnishments, and harassing phone calls. The automatic stay offers immediate relief and provides a structured environment for you to manage your debts.

Confirmation Hearing

About 20 to 50 days after filing, a confirmation hearing is held in the bankruptcy court. During this hearing, the judge reviews your repayment plan to ensure it meets the requirements of the bankruptcy code and is feasible based on your income and expenses. Creditors can object to the plan, but if it is deemed fair and workable, the judge will approve it.

Once your plan is confirmed, you begin making payments to the bankruptcy trustee, who then pays your creditors. It is crucial to make these payments on time to avoid dismissal of your case. The trustee also ensures that priority debts, such as taxes and child support, are paid first.

Completion And Discharge

If you successfully make all the payments outlined in your plan, you will receive a discharge of your remaining eligible debts. This discharge releases you from personal liability for most debts and prohibits creditors from taking any collection actions against you.

Legal Guidance For Filing Chapter 13 Bankruptcy

Putting together a solid Chapter 13 bankruptcy plan for Oklahoma courts can be tricky if you’re unfamiliar with the process. An experienced Oklahoma City Chapter 13 bankruptcy lawyer from Marty Martin Bankruptcy Law can help you through the process from start to finish. Preserving as much of your assets as possible. Call us today for a consultation.

Credit Eligibility

Bankruptcy is a serious process and must be contemplated and discussed before entering into it. However, it is not something to be dreaded or viewed negatively. After filing a bankruptcy petition, many may be surprised at when they will be able to start a new, promising financial future. Here is some of what you can expect:

- You may be approved for certain types of credit immediately. Creditors will likely see that you have just ended a bankruptcy proceeding and know you will not be able to file for bankruptcy again for several years.

- After approximately two to three years, you should be able to take advantage of good offers for car loans, and you should start receiving competitive rates on mortgages and home loans.

- Bankruptcy clears your debt, but not your credit history, so negative items will still appear even after your bankruptcy case has ended. However, these negative items will have less of an impact on your credit as time passes and also as you add more recent, positive items to your report. This will improve a petitioner’s credit rating perhaps more quickly than they thought.

- Despite the fact that bankruptcy can stay on your credit report for a period of ten years, it does not necessarily preclude you from being eligible for credit. In fact, it can help you establish a new, improved credit standing in a relatively short period of time.

An Oklahoma City Chapter 13 bankruptcy lawyer can explain all of this information in more detail during your consultation.

Use Caution

Just because those who recently closed their bankruptcy case may be eligible for credit sooner than they thought, it does not necessarily mean it is advisable to take advantage of such offers. Many credit card offers may carry high fees that apply before the card is ever used, as well as other charges that can lead to a financial situation similar to what led to bankruptcy in the first place. Use good judgment in choosing which credit accounts to open and work to re-establish your credit responsibly.

The Benefit of an Experienced Bankruptcy Attorney

It is important to note that many, if not all of these predictions depend on the specific circumstances of your particular case. An experienced bankruptcy attorney can better counsel you on what you can expect in your situation and advise you on how to avoid encountering problems in the future when your bankruptcy is behind you. Contact Marty Martin Bankruptcy Law to schedule a consultation with an Oklahoma City Chapter 13 bankruptcy lawyer. We are prepared to handle your case successfully.

Mistakes to Avoid When Filing Chapter 13 Bankruptcy Infographic

Oklahoma City Chapter 13 Bankruptcy Statistics – 2022 Update

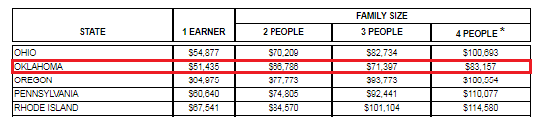

The following table provides median family income data reproduced in a format designed for ease of use in completing Bankruptcy

Ch 13 vs Ch 7

You might ask, why would I ever want to file a Chapter 13 instead of Chapter 7? The answer to that might be – you have no choice. If you make too much money as determined by the means test or have filed a previous Chapter 7 in the past 8 years this is your only option.

Also, in some circumstances, Chapter 13 is your best option. If you are behind on mortgage payments, car payments, taxes, among others, this option will enable you to pay back the amount that you are behind, often interest-free. All the while being under total protection from things like harassing phone calls, lawsuits, foreclosures, repossessions, etc.

My firm handles cases throughout the Oklahoma City Metro Area as well as Western and Southwest Oklahoma. We can assist you with this difficult decision. Please call my office today for a free bankruptcy consultation, either in my office or by telephone – (405) 255-2380. You may also email me anytime EMAIL ME!

Chapter 13 Bankruptcy Lawyer FAQ

If you are considering filing for Chapter 13 bankruptcy, you may want to speak with an Oklahoma Chapter 13 bankruptcy lawyer. Filing for bankruptcy can be complicated, and you want someone knowledgeable and experienced on your side. A lawyer from Marty Martin Bankruptcy Law can guide you through the process.

Does Everyone Qualify for Chapter 13 Bankruptcy?

No, you have to meet certain criteria to get your Chapter 13 bankruptcy case approved by the court. First, you can’t have more than $465,275 for unsecured debts and $1,395,875 for secured debts. You will also have to submit proof that you filed your federal and state income taxes for four years before your bankruptcy filing date. Lastly, you have to show that you have enough income to repay your debts. You may use income from multiple sources, including your regular wages, Social Security benefits, pension payments, unemployment benefits or income from self-employment.

How Long Does It Take to Complete Chapter 13 Bankruptcy?

This is one of the most common questions that people have about Chapter 13 bankruptcy. Before you file, understand that it can take three to five years to complete the entire process. That is much longer than it takes to complete Chapter 7 bankruptcy. However, if Chapter 13 is the right type of bankruptcy for your situation, it is worth it to wait that long.

Do I Need to Hire a Lawyer?

Although you are not technically required to hire an Oklahoma City Chapter 13 bankruptcy lawyer, it is highly recommended. Chapter 13 bankruptcy cases can be difficult to navigate on your own. You do not want to accidentally make a mistake and get your case thrown out. An experienced lawyer can help you decide if Chapter 13 is the best option for you and assist you with the mountains of paperwork. He or she can keep track of your court dates and keep you from making mistakes.

What Will Happen If I Miss a Payment Under My Repayment Plan?

While you definitely want to avoid missing schedule payments under your Chapter 13 repayment plan, things can happen. If you know that you are going to miss a payment, you should let the court know as soon as possible. They may give you more time to catch up on your payments. If you think that your financial emergency will last a while, you may want to request a modification of your monthly payments. Your lawyer can assist you with this.

Does Chapter 13 Bankruptcy Stop Creditors from Contacting Me?

When you are behind on your payments, you may have creditors contacting you daily. This can make you even more stressed. Fortunately, once you file your bankruptcy petition, an automatic stay will be issued and creditors will be prohibited from contacting you or collecting payments from you. If creditors still attempt to contact you, let you know as soon as possible.

Schedule a consultation with an Oklahoma City Chapter 13 bankruptcy lawyer from Marty Martin Bankruptcy Law.

Contact Our Oklahoma City Chapter 13 Bankruptcy Law Office

6440 Avondale Drive, #200-1 Oklahoma City, OK 73116

Oklahoma City Chapter 13 Bankruptcy Lawyer Google Review:

Client Review

“Mr Martin is amazing. He was and is still very helpful. Always willing to answer questions. I would definitely recommend his services.” Gary W.